This is the second of the two-part series, "The Future of Supply Chain Management in the Digital Age." You can access Part One here.

The Role of Automation and IoT in Warehousing and Material Handling

Supply chain automation has been around for decades, but unfortunately, too few operations are adopting it at a rate that supports the needs and wants of their consumers. Conversely, the Internet of Things (IoT) is a recent innovation that is gaining traction in some interesting ways.

Although they’re materially different in maturity, I’d argue that for most organizations, these two technologies share similar footing: underfunded and underutilized. However, both tools offer enticing benefits to the bottom line, speed, customer satisfaction and competitive advantage, and herein we’ll examine some of the reasons why.

Consumer Expectations Drive Up Supply Chain Costs

Fundamentally, the sole purpose of supply chain management is to meet the needs of consumers. And today’s consumers demand and expect more choices and faster service. Meeting these demands presents cost challenges throughout the supply chain. Offering more consumer choices results in more SKUs, which drives up bin requirements, travel time, inventory-control costs and slotting activities. Similarly, faster service requires an expanded geographical supply chain footprint to reach customers, which results in more frequent orders at smaller quantities, driving up the cost of picking, shipping and supplies. With increased costs and complexity, organizations need to focus on solutions that minimize future cost increases and (rapidly and continually) present opportunities for cost and performance improvement.

Whether you’re the hiring manager of a distribution center or just an avid consumer of industry articles, you’re likely aware of the mounting pressure on our industry. Labor shortages, rising labor costs and an impending explosion in the growth of consumer parcel demand have created a trifecta of worry for CSCOs and supply chain leaders. Let’s look at some supporting details.

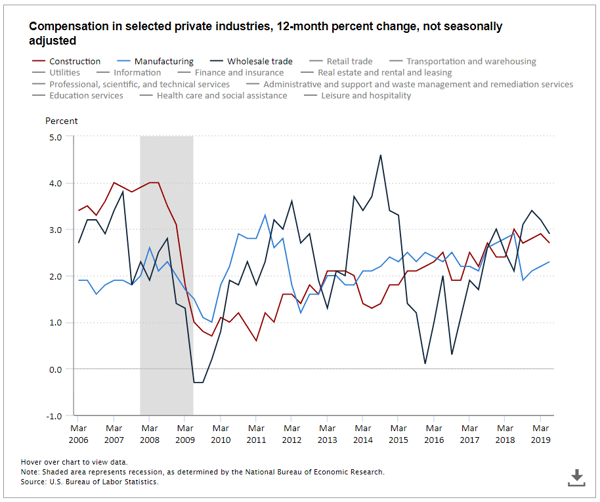

McKinsey suggests that parcel demand in the U.S. and other mature markets could roughly double over the next 10 years, growing to 25 billion parcels per year domestically. Couple that with the U.S. Employment Cost Index, which shows increased financial pressure on transportation and warehousing companies. Since around 2015, the year-over-year increases in compensation for transportation and warehousing have outstripped most other areas of private industry by a significant margin, topping the scale at a 3.8-percent year-over-year increase in September 2018, according to the Bureau of Labor Statistics.

As shown above, from 2010 to 2018, job openings for the transportation, warehousing and utilities industries reflected a growth rate 20 percent higher than that of all other private sector (nongovernmental) industries. Why? Within these industries, labor is getting scarce, driving wages higher.

The “Savings” of Not Digitizing Your Supply Chain Management Lead to Extra Costs in the Future

To paraphrase Henry Ford, if you need a machine and don’t buy it, then ultimately you will find that you have paid for it but don’t have it. Ford’s sentiment resonated throughout the manufacturing industry, changing it forever. Warehousing and material handling, however, still have work to do. A recent benchmarking study by the Warehousing Education and Research Council (WERC) showed that fewer than 20 percent of distribution centers (DCs) have incorporated robotics and automation or IoT into their operations. The same study showed that more than 30 percent of all DCs had no immediate plans to incorporate robotics and automation into their operations. This leaves money, opportunity and competitive advantage on the table.

Consider this: Picking is one of the biggest labor drivers in DCs. Most pickers rack up a pretty good number of steps on their fitness trackers each day because just getting to the product can comprise up to roughly 50 percent of their work time. It’s a fact of life that many DCs would love to eliminate (or at least reduce) this, because it has a direct impact on the operation’s P&Ls. An average organization might pick and ship somewhere between 25 and 45 tasks per hour. For example, if Company A processes 2 million lines per year at 45 tasks per hour, it will spend approximately 44,000 hours, or 21 FTEs, just in picking.

Because automation for DC operations has been around for decades, there are many reliable “part-to-picker” automation options available. Each provides productivity capacities well beyond that of a human operator. So, a threefold improvement in tasks per hour for Company A would reduce overall pick labor by greater than 65 percent and, depending on average labor cost, could pay for the investment in less than two years. If two years sounds like a hard pill to swallow, please also consider the alternative: labor shortages, inevitably increasing costs and increasing demand from customers.

IoT Supports New Digital Supply Chain Data Capture

IoT is a relatively recent addition to the supply chain practitioner’s toolkit, but it has a very bright future. Sensors and GPS are finding their way into material handling equipment (MHE), our warehouse aisles, our delivery fleet and even our products to provide valuable insights into supply chain events and patterns. I like to think of IoT as Data Collection 2.0 — a modern method of collecting time, space and activity information that was previously hidden from the metrics-minded. IoT sensors and accompanying telemetry systems can provide real-time feedback on the status of MHE devices, giving companies invaluable information that allows them to dial in the size and effectiveness of their MHE fleet.

Preventative maintenance is one of the most underrated — yet vital — functions in any modern warehouse. With IoT sensing and data collection, preventative maintenance can be triggered based on usage hours, fault codes or certain operating conditions, and it’s proving more reliable than traditional scheduling methods.

Now, the fun stuff. Have you ever wondered how much time your $12,000 rider pallet jack spends traveling from one end of your warehouse to the other without a load? Deadheading in material handling is no less acceptable than it is in trucking, but it hasn’t always been an easy thing to measure. Load sensing can help you detect the size of the load that each piece of equipment is (or isn’t) carrying, and telemetry systems take it a step further. IoT with a telemetry system can construct a virtual timeline of your fleet’s movement throughout the warehouse. “Why is Aisle 14 always so congested?” you might ask. “Where is the most accident-prone area in the facility?” Or, “What space am I not using to its full potential?” The data collection benefits from IoT are creating new opportunities — and uncovering previously hidden opportunities — for continuous improvement in the digital-age warehouse. And with 5G right around the corner, advanced analytics progressing at an astounding rate and cloud computing enabling cheaper and faster solutions, logisticians have tremendous new fuel for the fire — all available for the organization that is willing to embrace change and invest in its future and its customers’ future.

Automation is a clear path to labor-cost reduction, and IoT offers continuous improvement opportunities that were previously hidden in the dark spots of our traditional data-capture methods. These are two of the elements that define supply chain management in the digital age.

To learn how a part-to-picker system might benefit your supply chain, contact Shyft Global Services’ supply chain management team, and we’ll share some details on how we’re future-proofing our own operations.

About the Author

Chris Wright is the vice president of Supply Chain Management Services for Global Lifecycle Management (GLM), a specialized solution business within Tech Data. He is responsible for the growth and success of global third-party logistics and fulfillment solutions tailored to the needs of modern original equipment manufacturers around the world.

Chris Wright is the vice president of Supply Chain Management Services for Global Lifecycle Management (GLM), a specialized solution business within Tech Data. He is responsible for the growth and success of global third-party logistics and fulfillment solutions tailored to the needs of modern original equipment manufacturers around the world.